When it comes to decarbonization, there are few elements more critical to the transition than copper. But copper miners are also working hard to decarbonize their own operations. North American Mining spoke to Nicole Witoslawski of the International Copper Association about the sector’s journey to net zero.

By Jonathan Rowland

There is an implied narrative in many discussions about mining and the environment that views the industry as a villain of the story. But while the industry should take (and in many areas is taking) responsibility for the impact of its operations on the climate and the environment, this villainous reputation is unhelpful and simplistic. A different narrative is needed that sees the industry in a much more heroic light – flawed, perhaps, but ultimately playing a crucially positive role in global efforts to clean up the climate.

Copper is a case in point, as Nicole Witoslawski, the association’s director of public affairs and communications, told North American Mining. “While copper has always been a versatile material, the functionality and efficiency it delivers to green technologies is unmatchable. It is therefore essential for a vast array of decarbonizing technologies, which, when taken together, have the potential to account for two-thirds of global greenhouse gas emissions’ abatement by 2050.”

In contrast, copper production accounts for just 0.2% of global greenhouse gas emissions. In comparison to its crucial role in reducing carbon emissions, copper’s own carbon emissions are thus relatively small. And while the industry is taking important steps to reduce this carbon footprint, the road to net-zero zero copper must be pragmatic and ensure the industry remains capable of supplying this vital material needed to enable global decarbonization.

A pathway to net-zero

Founded in 1962 as the International Copper Research Association, today the ICA represents the global copper industry on issues critical to securing copper’s future growth. Member companies represent more than 50% of global copper production; it also connects upstream mining, smelting and refining sectors with the downstream copper fabrication sector through its Copper Alliance partners.

In March, the association launched its pathway to net-zero copper, based on existing work by its members, to outline the decarbonization options available to the sector, their timeframe for implementation, and what impact they may have in terms of carbon emissions and cost. “ICA member companies are already taking strong, decisive steps to decarbonize their operations,” said Witoslawski. “Our industry decarbonization roadmap builds on these early successes and provides an aligned, actionable pathway for the industry to collectively reach net zero by 2050.”

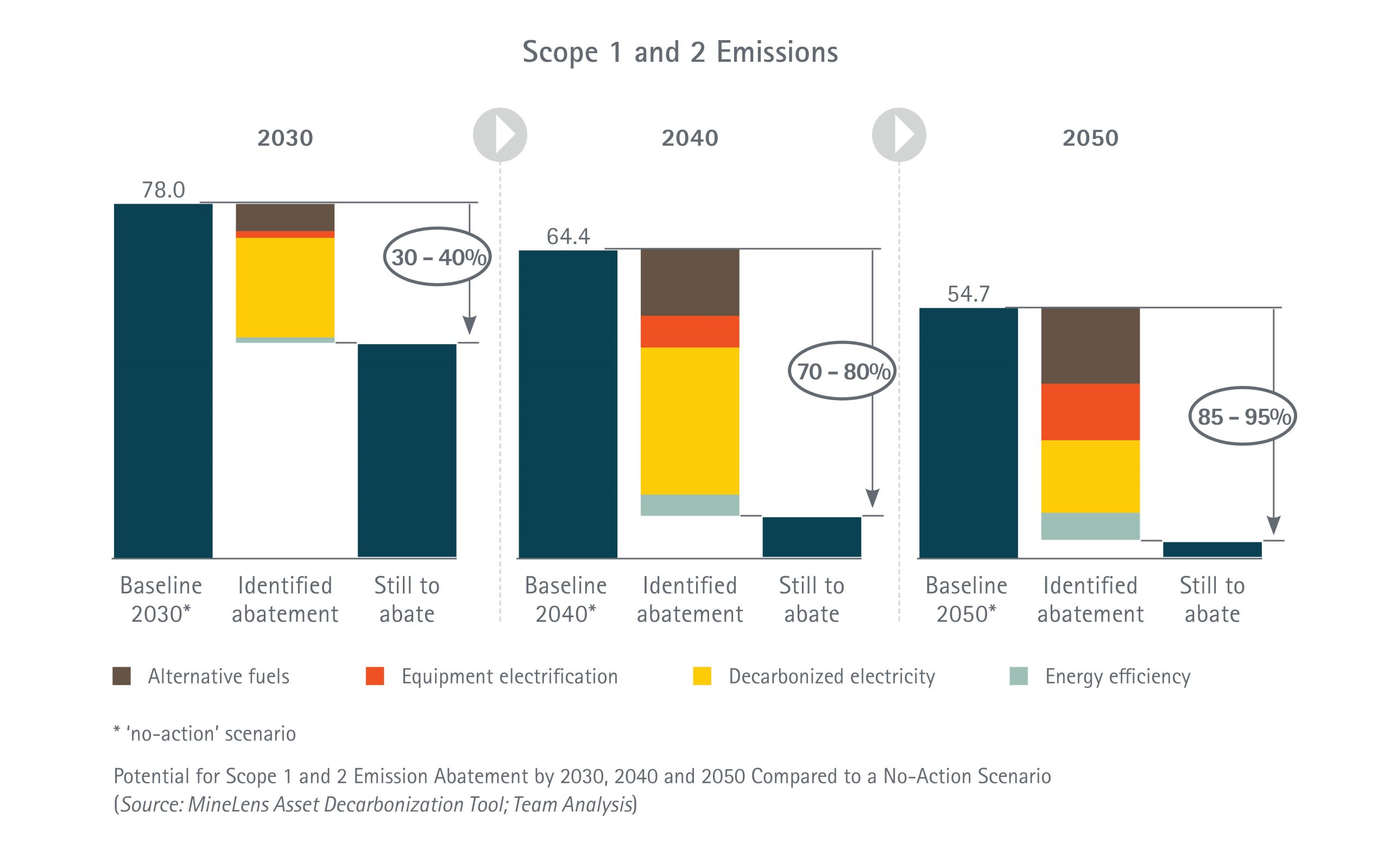

The pathway comprises several key levers for the abatement of Scope 1 and 2 carbon emissions (Figure 1):

- A decarbonized electricity supply coupled with electrification of equipment.

- Alternative fuels (e.g., alternative diesels and hydrogen).

- Efficiency improvements, e.g., higher efficiency grinding media, efficiency gains in smelting, leaching, etc.

“By 2030, an estimated 30% to 40% of carbon emissions can be reduced compared to the baseline, mainly through the switch to green electricity,” explained Witoslawski. “Alternative fuels and the electrification of equipment play a limited role in this first period due to constraints on the availability of these fuels and technologies. But looking out to 2040, battery-electric or fuel cell trucks, coupled with growing availability of green hydrogen, will enable a reduction of emissions by 70% to 80%. By 2050, we see emissions reduction of 85% to 95% via further electrification and widespread availability of green hydrogen. In addition, efficiency gains will represent 7% to 12% of the total abatement potential between 2020 to 2050.”

Electrification

Electrification is an essential element in many sector pathways to net zero: e-mobility is the example par excellence, but copper is no different. (It is also one of the reasons why copper is such an important part of the overall transition to net zero.) But electrification is only a solution when combined with a decarbonized electricity supply. In the copper industry, this will take two forms: sourcing power purchase agreements that specify carbon-free energy supply and installing renewable (wind and solar) energy farms at copper production sites.

Industry players are already moving in this direction. In the U.S., Rio Tinto Kennecott – with its flagship Bingham Canyon mine, which supplies 15% of U.S. copper demands – has permanently shut its last coal plant and become a leader in solar and wind power. This has reduced its carbon footprint by 65%, or 1 million tons of CO2, as well as reducing air pollutants emissions by 6000 tons per year. Moving south of the border, Grupo México has invested $260 million in the 168-MW Fenicias wind farm in Nuevo Leon, Mexico, which will provide 600 GWh of zero-carbon energy to the company’s nearby mining and metallurgical operations. The installation was due to go into operation this year and will eliminate 0.25 million tCO2e of annual carbon emissions: 16% of the company’s 2021 Scope 2 emissions or 6% of its mining division’s Scope 1 and 2 emissions.

Alternative fuels

The switch from fossil fuels to cleaner energy also encompasses the adoption of carbon-free fuels, such as alternative diesels and green hydrogen for mobile equipment, or green hydrogen, biogas and biochar for smelting operations.

On the mining side, Kennecott is again leading the way. The site is trialing the use of alternative diesel for mine haulage in collaboration with engine manufacturer, Cummins, comparing acceleration, speed, cycle times, fuel usage, and engine inspection reports for two trucks running with alternative diesel and two running with conventional diesel. The trial complements an earlier successful trial of renewable diesel at Rio Tinto’s US Borax operation (Ed. note: for more on the use of alternative diesels in the mining industry, check out the article ‘Diesel. But not as we know it’ from the June 2023 issue of North American Mining.)

The company hopes the trials will ultimately allow it to move to a fully renewable fleet at its U.S. operations, significantly reducing the carbon footprint of its operations in the country.

The ICA roadmap also highlights Anglo American’s efforts to decarbonize its mining operations via green hydrogen. Its integrated zero-emission haulage solution uses excess renewable energy generated by onsite renewable installations to produce hydrogen, which is then used to fuel its nuGen zero-emission haulage truck. The company is aiming to convert all its haul trucks to hydrogen by 2030.

In the smelter, ICA member Aurubis has tested the use of hydrogen as a reducing agent in copper anode production at its Hamburg, Germany, plant, replacing the use of natural gas. The company announced the production of the first copper anodes with hydrogen in May 2021. Importantly, the use of hydrogen as a reducing agent releases water vapor, instead of the CO2 that is produced when natural gas is used.

Efficiency, efficiency, efficiency

Copper miners are also turning to technology – including the latest digital innovations – to help increase the efficiency of production, allowing them to increase output, while still limiting carbon emissions, even as ore grades decline.

Freeport-McMoRan’s Baghdad mine in Arizona demonstrated the value this can bring after it began using AI and remote sensors to distinguish between ore types entering its mill. This allows the mine to optimize mill control according to the specific properties of the ore and resulted in a 10% increase in copper production. The technology has since been rolled out at its Morenci complex, also in Arizona. The company has also reduced energy consumption by 20% by implementing innovative high-pressure grinding rolls in place of traditional milling technologies.

Other examples of innovation at work today at copper mines include:

- Rio Tinto using AI for monitoring and process optimization through its Mine Automation System. This acts like a network server, bringing together data and real-time visualizations through digital twinning technology at 98% of its mine sites, helping the company increase the speed and efficiency of its automated processes, including its automated vehicles.

- Anglo American employing microwave technology to precondition rock, so it is faster and less energy-intensive to mine, as well as automated and continuous rock cutting equipment to eliminate the need for explosive blasting.

- Swedish mining company Boliden introducing automated and electric mining vehicles and haul trucks to increase operational efficiency.

- BHP automating drill technology at its Spence mine in northern Chile.

Meanwhile, ICA members, including Teck Resources, BHP Group, and Freeport-McMoRan, are also investing in new processes to make extraction from lower grade ores possible, enabling these companies to re-process mine tailings and recover previously lost material.

Roadblocks to decarbonization

However, achieving net-zero copper is not “solely dependent on the industry itself,” pointed out Witoslawski. “Other factors play a role, most obviously access to clean electricity and new technologies at scale. However, product design that facilitates recycling and incentives for end-of-life collection are also needed. Additionally, effective and efficient regulatory frameworks play a key role.”

The ICA roadmap highlights the following areas where external support will be needed to support the copper industry’s net-zero targets:

- The introduction of transparent – and preferably

worldwide – carbon pricing to facilitate investment decisions for decarbonization and create a level playing field in the integration of externalities into product costing. - Access to public funds for innovation to support development of additional decarbonization solutions.

- Faster permitting for new mining assets and capacity expansions to enable the industry to meet growing demand on time, and for the installation of onsite clean electricity generation capacity.

- A predictable and stable regulatory environment within which the industry can feel confident making the

substantial capital expenditure required for capacity expansion and decarbonization. This includes fair and stable royalties, as well as long-term mining licenses. Protection mechanisms against external shocks, such as energy price hikes, should also be considered by lawmakers. - Coherent chemical and product regulations to allow the optimized and responsible contribution of copper and its byproducts, such as iron silicates, to the transition toward climate neutrality.

“Each of these areas present important opportunities to dialogue,” continued Witoslawski. “We see such collaboration with stakeholders across the value chain as key to achieving net zero. For example, the ICA and its members have a long history of public-private partnerships, often through UN programs, in the fields of energy efficiency and energy access. We are now working to broaden these efforts by engaging with policy makers, suppliers and customers, academic institutions, and like-minded organizations to achieve our common net-zero goals.”

Decarbonization is also a skills challenge. The industry will need the support of a skilled workforce to meet production targets, to implement new technologies, especially on the digital side, and to effectively measure and monitor carbon reduction initiatives. “These new skills can be acquired through training and education programs for existing staff, as well as by hiring new employees with a different profile,” noted Witoslawski. “But here too collaboration and partnership are important, especially as there will be significant demand for these skills across industries. Support for and from local educational institutions will therefore also be indispensable.”

Circularity

In addition to decarbonizing primary copper production, maximizing circularity within the copper life cycle can also support decarbonization goals, as recycled copper has a much lower carbon footprint than mining and refining new metal.

“As a durable, versatile and infinitely recyclable material, copper provides longevity to a wide range of applications that can be recycled at their end-of-life and reintroduced into productive use,” said Witoslawski. “ICA members already partner with the copper value chain to recover this material, recycling about 4 million tonnes of consumer scrap in 2018. With 70% of copper used in electrical applications, many initiatives focus on e-scrap recycling.”

The dominant recycling loop comprises pre-consumer “new” scrap, accounting for about 60% of recycled copper. “Throughout the copper value chain, smelters, fabricators, and manufacturers are working to ensure that scrap produced as a result of pre-consumer product development is captured and reintroduced back into the scrap stream,” continued the ICA executive.

This totaled about 5.4 million tonnes of copper in 2018 and, as a result, 83% of copper makes it through the fabrication process and into final products; this compares to 59% of aluminum. Due to its natural properties, 80% of copper is also used in unalloyed form, allowing it to be refined without loss of quality.

However, “one needs to keep in mind that copper applications often have long lifespans, making the copper they contain unavailable to recycle, while demand is increasing significantly. Secondary copper will therefore never be enough to meet demand. Even if there was a 100% recycling rate for copper, the World Bank has calculated that would only reduce the demand for new copper by 26%. Primary copper will continue to be needed,” concluded Witoslawski.